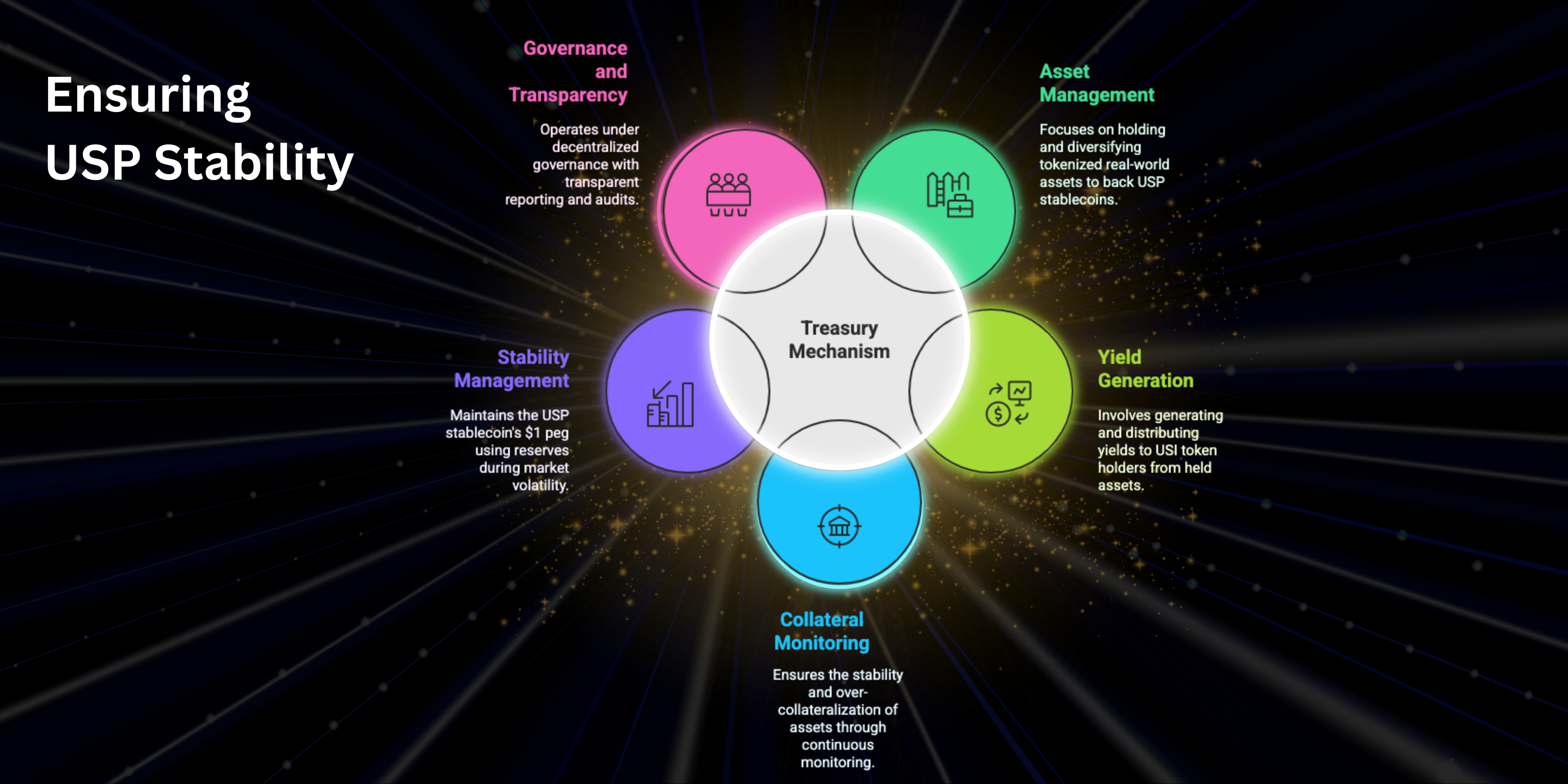

Treasury Mechanism

The Treasury Mechanism of STBL plays a pivotal role in maintaining the stability of the USST stablecoin and ensuring sustainable yield distribution for YLD token holders. It is a dynamic system designed to optimize asset management, facilitate transparent operations, and ensure the protocol remains resilient against market volatility.

1. Asset Management and Allocation

- The STBL Treasury primarily holds tokenized real-world assets (RWAs) such as:

- U.S. Treasury Bills

- Other low-risk, yield-generating financial instruments

- These assets serve as the collateral backing the circulating USST stablecoins.

- The Treasury uses a diversified allocation strategy to ensure stable and predictable yields while mitigating potential risks.

2. Yield Generation and Distribution

- The Treasury generates yield through interest payments from the RWAs it holds.

- These earnings are distributed to YLD token holders, providing a passive income stream.

- A portion of the yield may also be directed towards operational expenses, protocol development, and enhancing the ecosystem’s resilience.

- The transparent tracking of yield distribution ensures equitable returns for participants.

3. Collateral Monitoring and Rebalancing

- STBL’s Treasury Mechanism includes continuous monitoring of the collateral value using on-chain oracles.

- If the collateral value fluctuates, the system dynamically rebalances assets to maintain the required over-collateralization ratio.

- In cases of extreme market conditions, the Treasury can liquidate specific assets to restore protocol stability.

4. Stability Management through Treasury Reserves

- A portion of the Treasury is maintained as a stability reserve to act as a buffer against market volatility.

- These reserves are strategically deployed during periods of price instability to protect the $1 peg of USST.

- If collateral value drops, the reserves can be used to repurchase USST from the market, supporting price stabilization.

5. Treasury Governance and Transparency

- STBL’s Treasury operates under a *decentralized governance model, where *YLD token holders can participate in decision-making.

- Governance proposals may include decisions on asset allocation, risk management policies, and yield distribution adjustments.

- Transparent reporting and regular audits ensure all participants have visibility into the Treasury’s activities.

6. Profit Redistribution

- Unlike traditional stablecoins where profits are retained by centralized entities, STBL redistributes its profits back to the users.

- Yield generated from RWAs is distributed to YLD token holders, providing equitable access to the protocol’s financial gains.

- This model aligns with STBL’s mission of democratizing financial benefits using blockchain technology.

7. Risk Mitigation and Contingency Planning

- The Treasury Mechanism employs various risk management strategies, including:

- Diversified Collateral Portfolio: Reducing dependence on any single asset type.

- Automated Liquidation: Preventing under-collateralization through swift asset liquidation.

- Reserves Allocation: Maintaining emergency funds to handle unforeseen volatility.

- These mechanisms ensure the long-term sustainability and robustness of the protocol.

The Treasury Mechanism in STBL is a well-structured system designed to ensure the stability of the *USST stablecoin, generate yield for *YLD token holders, and maintain the protocol’s overall health. Through transparent management, efficient asset allocation, and proactive risk management, the Treasury ensures the protocol's resilience in various market conditions.